nh bonus tax calculator

Besides the federal progressive tax bracket system there also exists the alternative minimum. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

If your state does.

. NH Department Of Labor. New employers should use 27. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

Paycheck Results is your. For transactions of 4000 or less the minimum tax of. Nh Bonus Tax Calculator.

From 170050 to 215950. The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase. Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

This New Hampshire bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. New Hampshire Bonus Tax Aggregate Calculator Results Below are your New Hampshire salary paycheck results. New employers should use.

Your average tax rate is 1198 and your. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. On average homeowners in.

New Hampshire has a population of over 1 million 2019 and is also known as the Granite State for its extensive granite formations and quarries. Federal Bonus Tax Percent Calculator. From 215950 to 539900.

The aggregate method or the percentage method. With this tax method the IRS taxes your bonus. New Hampshire Income Tax Calculator 2021.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. The results are broken up into three sections. Open an Account Earn 14x the National Average.

Employers typically use either of two methods for calculating federal tax withholding on your bonus. The median household income. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year.

No monthly service fees. Nh Bonus Tax Calculator. New employers should use 27.

Bonus Total. The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. Name of Average wage.

Easy 247 Online Access. The assessed value multiplied by the real estate.

Bonus Tax Rates Aggregate Bonus Pay Calculator Onpay

Aarron R Dupuis Director Of Community Impact At Campus Compact For New Hampshire Concord New Hampshire United States Linkedin

How Bonuses Are Taxed Credit Karma

How To Tax Bonuses Overtime Pay In Each State Sentrichr

How The Tax Cuts And Jobs Act Is Helping New Hampshire Americans For Tax Reform

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Individual Income Tax Colorado General Assembly

Llc Tax Calculator Definitive Small Business Tax Estimator

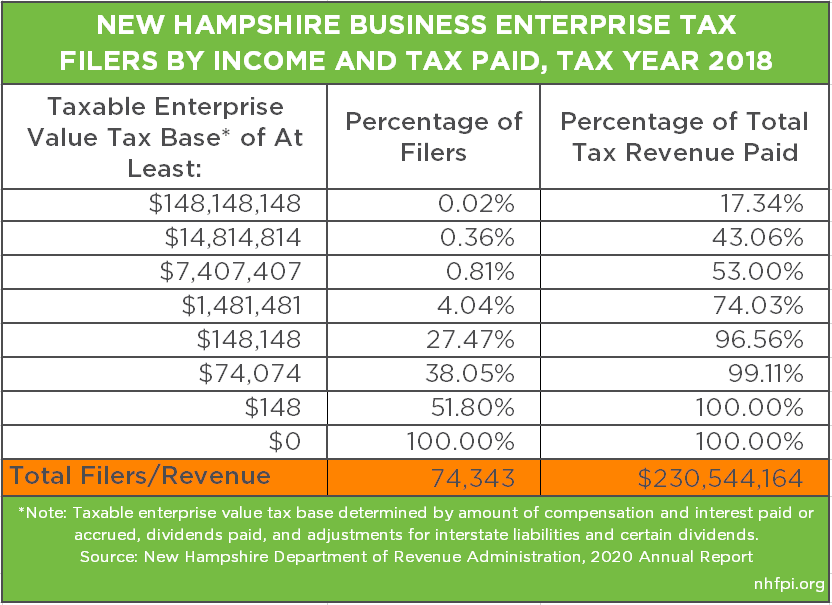

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

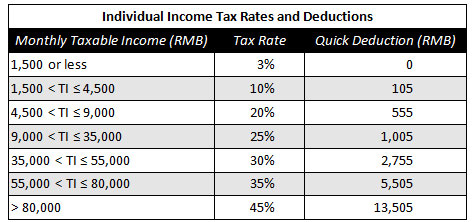

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

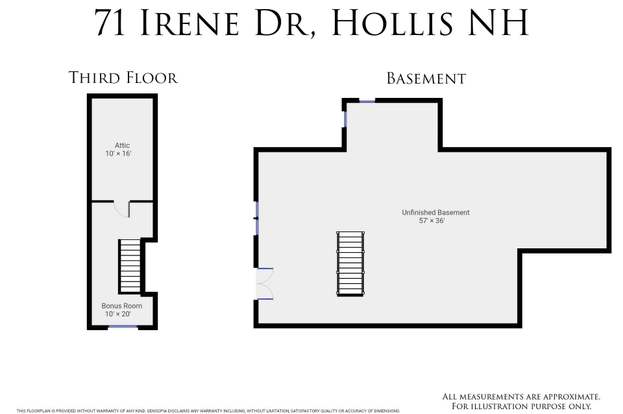

71 Irene Dr Hollis Nh 03049 Mls 4887762 Redfin

The Complete J1 Student Guide To Tax In The Us

Marriage Tax Penalties And Bonuses In America 2020 Study

Bonus Tax Calculator Percentage Method Business Org